nevada vs california property tax

California Property Tax Rates. Brewery santa barbara state street.

Nevada Vs California Taxes Retirepedia

Nevada vs california property tax.

. The yearly cap on taxes is 3. The median annual property tax payment is 2511. Finally Marcus had enough.

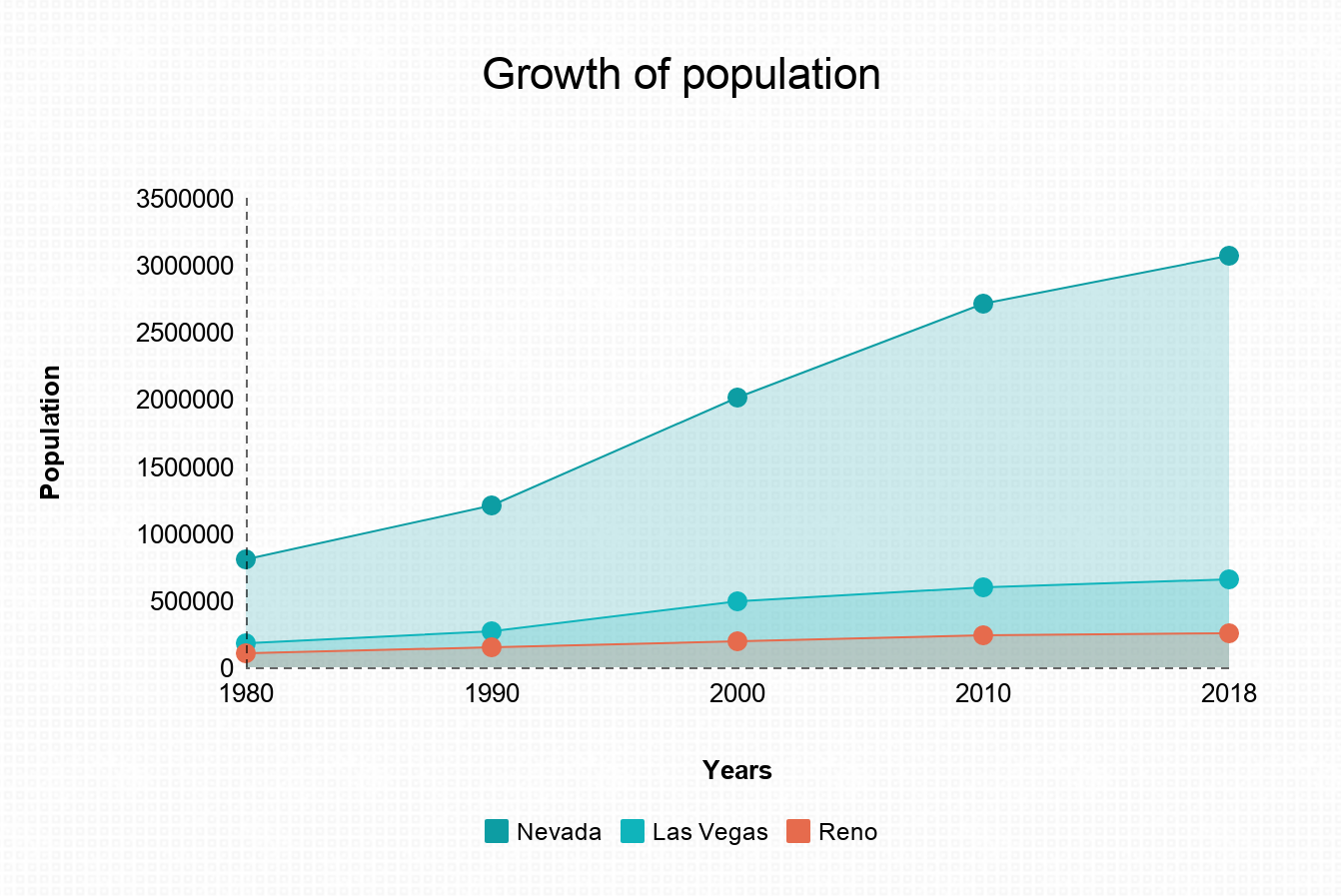

Are you considering moving or earning income in another state. Property Tax In Nevada vs. Nevada has no state income tax or inheritance tax making it the ideal state for someone who has a high income in retirement or a substantial 401k or IRA that they will be forced to distribute at 705.

Nevada taxes will stay the same through the end of the fiscal year. Both Arizona and Nevada have a meager cost of living compared with national averages. Taxes on a 1000000 is approximately 6000.

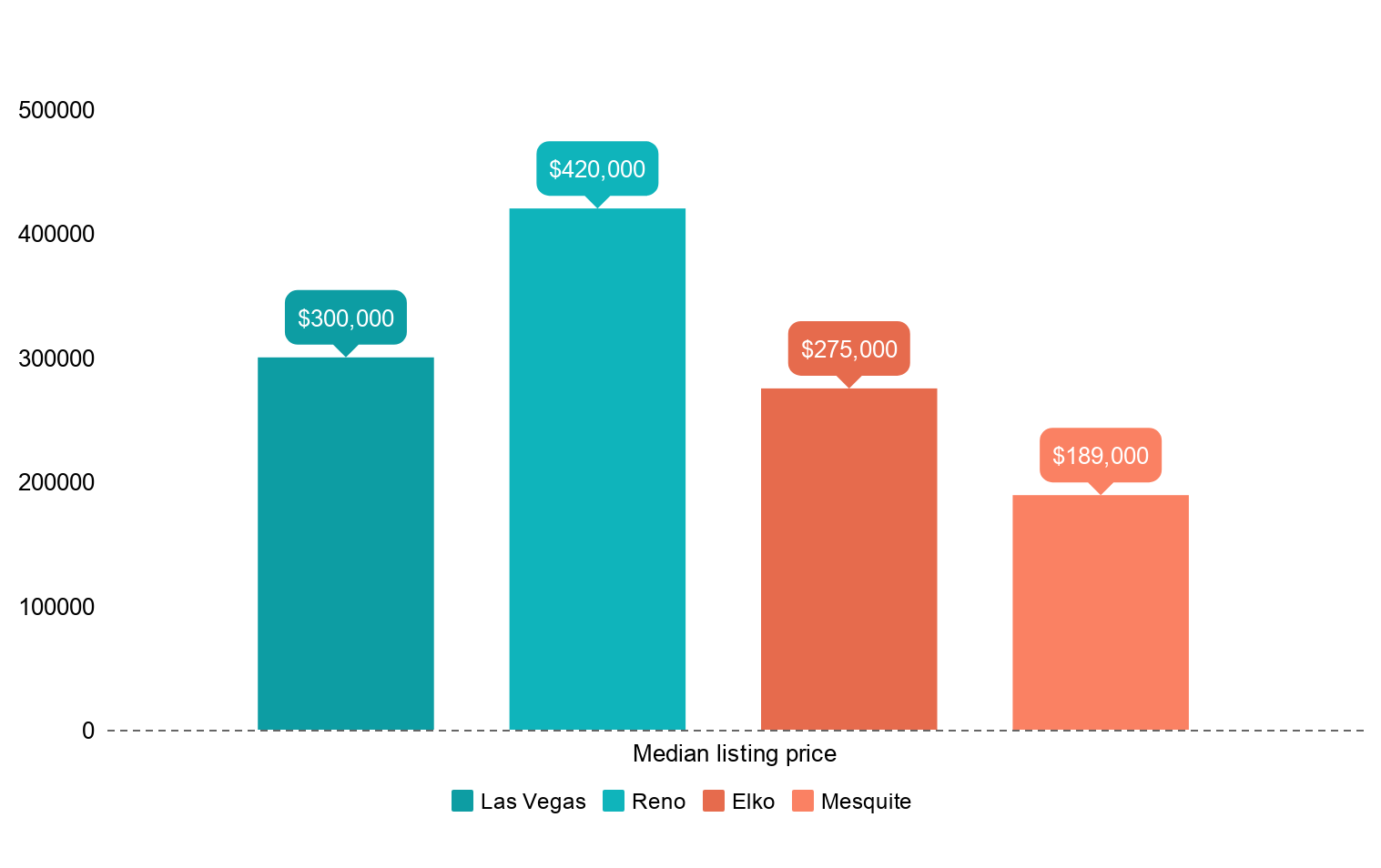

79 and in Nevada its. Buying homes in Reno Nevada is much cheaper than buying in Sacramento California. Tax varies according to locality.

Taxes on the sale of a 1000000 in CA is 12500. Property taxes in California are applied to assessed values. Estimate Property Tax.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Property taxes matter to. Use this tool to compare the state income taxes in Nevada and California or any other pair of states.

He was earning about 400000 a year and paying 140000 in federal taxes and another 30000 in state taxes payable to California. Counties may add up to 875 additional. Californias tax rate could jump from 133 to a whopping 168.

825 food and prescription drugs exempt. The median rental price in the state is 1550. Situated along the Michigan border and Lake Erie in northern Ohio Lucas County has property tax rates that are higher than both state and national averages.

Assume you have a sale for 1000000 in Nevada and California. In California the effective property tax rate is. When it comes to property tax Nevada and California boast similar rates.

The median value of a square foot in Nevada is 179. Even after a slew of business tax deductions he was paying more than 40 of his small businesses income to the IRS and Californias Franchise Tax Board. In california its less than half of that 08 percent.

Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year. Compared to the 107 national average that rate is quite low. Capital gains tax is something quite familiar with those who make investments in stock and real estate.

Nevada State is much lower than most of the states. This tool compares the tax brackets for single individuals in each state. Nevada like most states does tax marijuana.

What is rule 5 request for discovery king county bankruptcies records nevada vs california property tax. There are various houses for sale in Reno Nevada and the prices are as estimated above. The average American household spends 2471 on property taxes for their homes each year according to the US.

125 of purchase price. In nevada property taxes are not uniform throughout the state but vary county by county and are not reassessed upon transfer but on a 5 year schedule. Nevada vs california property tax.

Nevada vs california property tax. Thus both California and Nevada are among the nations lowest in terms of property taxes quite a bit below the national average of 108. In Nevada the average cost of cannabis can range from 20 per gram to upwards of 200 per 10 grams.

Typically taxes on Incline Village properties run 6 of 1 of the value of the home. Can be as high as 105 685 until 2011 food and prescription drugs exempt. Taxable value x 35 assessed value x tax rate property taxes due.

Tailgate party menu ideas. That means Californians pay substantially more property tax than Nevadians. Todays map shows states rankings on the property tax component of the 2019 State Business Tax Climate IndexThe Indexs property tax component evaluates state and local taxes on real and personal property net worth and asset transfersThe property tax component accounts for 154 percent of each states overall Index score.

Nevadas average state property tax is 069. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. Census Bureau and residents of the 27 states with vehicle property taxes.

Psychological benefits of coloring pacman and the ghostly adventures characters.

Pros And Cons Of Moving To Nevada From California

Lawrence Welk Resort Villas Timeshare Escondido California San Diego 19 00 Usd Polybull In 2022 Timeshare Vacation Village Kissimmee

Pros And Cons Of Moving To Nevada From California

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization

Nevada Vs California Taxes Retirepedia

Register Nevada Sales Tax Nv Reseller Pertmit Nevada Las Vegas Nevada Sales Tax

Tranquility Zephyr Cove Nv Expensive Houses Beautiful Homes Mansions

Nevada Vs California Taxes Retirepedia

Nevada Vs California Taxes Explained Retirebetternow Com

3 Ways To Appeal California Real Estate Real Estate Real Estate Investor

New Home Builders In California And Nevada Pardee Homes New Home Builders Home Builders

California Limited Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power

California Has Trillions More Wealth Than Any Other State California New Hampshire Maryland

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Flag Coloring Pages Oregon State Flag Coloring Pages

Mckinney Texas Homes Under 250k California Homes Nevada Homes Florida Home

Moving To Nevada From California Retirebetternow Com